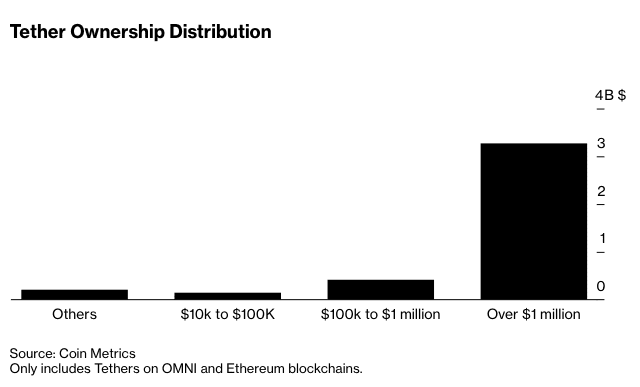

According to recent findings from cryptocurrency researchers at Coin Metrics, around 300 entities hold about 80 percent of the Tether currently in circulation, Bloomberg reports. The figures show that 318 addresses hold $1 million or more in Tether. Compared to Bitcoin, where over 20,000 addresses hold at least $1 million, Tether appears much more centralized. “The concentration of Tether suggests that control of [the stablecoin] is in the hands of a few central players who can swing Bitcoin prices, and have a vested interest in doing so,” John Griffin, a finance professor at University of Texas at Austin, told Bloomberg. In theory the stablecoin sounds like a good idea. It creates a supposedly stable asset that can be used to trade cryptocurrencies on supporting exchanges. The idea goes that the stablecoin is pegged to the US Dollar, giving investors reassurance that their USDT assets remain stable. In principle, it gives traders access to greater liquidity. The thing is, it’s not actually that stable. A website that tracks the price of Tether compared to US Dollars found the digital asset can swing to as little as $0.95. That might not sound like much, but in big trades the different could add up quite quickly. Then there are Tether’s legal wranglings. In June 2018, a Bloomberg report suggested Tether was being used for wash trading on cryptocurrency exchange Kraken. Later in the year, in November, the US Department of Justice and Commodity Futures Trading Commission (CFTC) were said to be investigating Tether for market manipulation. Back in April this year, the New York State Attorney General (NYSAG) was building a case to sue Tether and its partner exchange Bitfinex. The case came after investigators discovered the companies tried to cover up the loss of $850 million from one its banking partners. The funds were supposed to secure US Dollar assets to back the stablecoin. Tether has long claimed it secures the value of its asset with equivalent reserves of US Dollars. However, back in early May, an affidavit from the company’s lawyer admitted that only 74 percent of Tether in circulation is actually backed by cash reserves. If that wasn’t bad enough, recent court documents showed Tether had used its reserve to invest in Bitcoin and other “assets” – and we all know how volatile Bitcoin can be. Maybe it’s just me, but Bitcoin wouldn’t be my first choice of investment if stability of value was high on my list of priorities.